montgomery county today

77

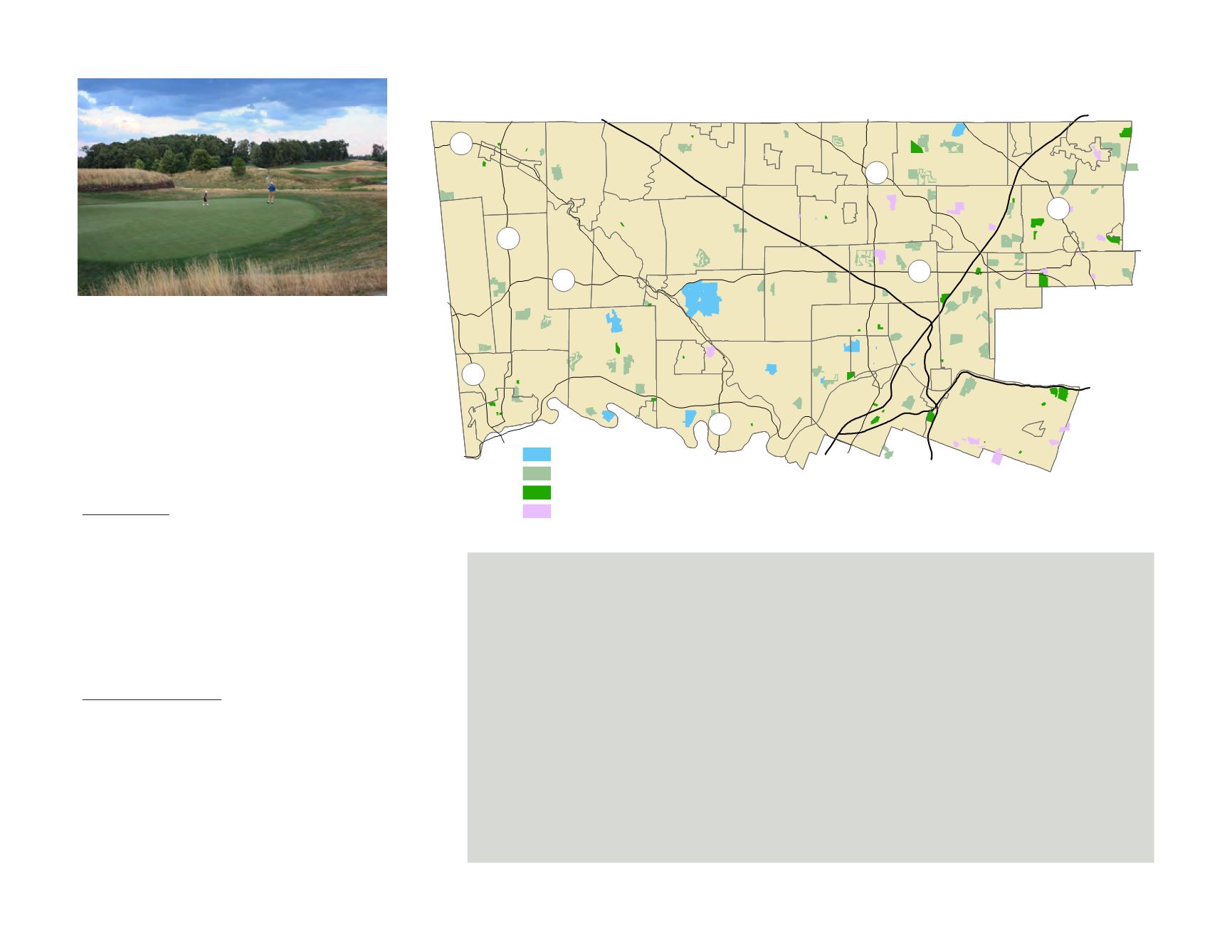

institutions, camps, recreation associations,

cemeteries and private foundations own open land

in the county. These properties may be available

for public use, depending upon the objectives and

regulations of the organization. Some institutional

lands, such as school properties, are used for active

recreation and sports leagues, while other

institutional land, such as cemeteries, provides

informal access to the public.

Golf Courses: Montgomery County residents

enjoy a wide variety of golf opportunities on the 56

golf courses that comprise 8,118 acres in the

county. Golf courses provide several benefits to

the county. As largely open land, they provide

vistas and natural landscapes which can reduce

stormwater impacts, enhance water recharge, and

provide habitat. Golf courses also provide local

economic opportunities and can be an important

amenity available to attract tourists.

Corporate Properties:

A few corporate research

and office properties in the county may contain

open land with woodlands, meadows, and stream

corridors. Although not public land, corporate

lands may serve as natural habitat areas, and

local trail networks may pass alongside or even

link into employee walking trails maintained on

these properties.

Preferential Tax Assessment

The county is able to offer two forms of reduced property tax as incentive for property owners to conserve

their land. The Clean and Green Act (Act 319) provides assessment of agriculture land based on its

production value. Act 515 allows for the establishment of covenants that reduce the assessed value of

property for a specified time frame to maintain an open space use of the property.

The Clean and Green Law, Act 319, was enacted in 1974 to allow for the preferential assessment of

farmland. As of January 3, 2013, 1,674 parcels of land in the county totaling 49,810 acres are assessed

under Act 319. Under this voluntary program, qualified land is assessed based upon agriculture production.

If the property is no longer used for agriculture purposes and developed, the property owner is subject to the

payment of roll back taxes and interest penalties covering a seven year period.

Covenants established under Act 515 can be used on select properties which contain various open space

qualities. Through the establishment of a 10-year covenant, the property owner agrees to maintain the land

as open space while the tax assessment is lowered to reflect that use. Violation of covenants can trigger roll

back tax and interest penalties. On January 1, 2013, 78 parcels with 7,804 acres were under Act 515.

Playing golf at the Rivercrest Golf Course near Mont Clare.

FIGURE 51:

Institutional Open Space

¯

Pottstown

Norristown

Lansdale

Collegeville

Jenkintown

Conshohocken

476

276

76

476

t

u

422

t

u

202

611

100

309

Hatboro

Ambler

Pennsburg

73

663

29

29

73

Cemetery

Governmental Facility

Golf Course

College Campus

Source: Montgomery County Planning Commission